Customers who choose advice on financial products should be able to rely on expert advice. The core of the Wft professional competence requirements is that expert advice to the customer is central. The Dutch Association of Insurers endorses this aim.

Current

Backgrounds

Customer can count on expert advice

In recent years, insurers have made great efforts to make insurance easier for the customer. They have also improved the provision of information on insurance products, including through the introduction of insurance cards stating what a consumer can expect from a product. Nevertheless, insurance can still be experienced as complicated by customers.

It is therefore of great importance that customers of insurers can rely on the expertise of employees. They must be able to answer customer questions in clear terms, explain and advise insurance products. This requires that employees continuously keep their (professional) knowledge up to date.

The Association believes that safeguarding knowledge, skills and skills is essential for healthy business operations of insurers. Above all, it is in the interest of the customer who counts on good financial advice. Demonstrable expertise is therefore an important factor for the further restoration of confidence in the sector.

The current professional competence requirements

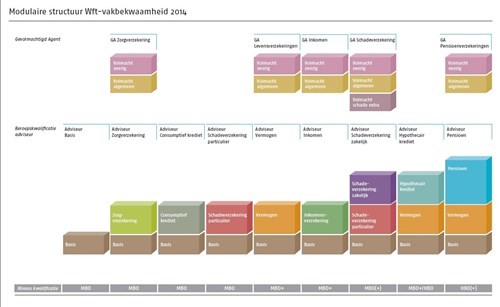

Since 1 January 2014, new professional competence requirements apply to financial advisers. These requirements stem from the Financial Supervision Act (Wft) and are laid down in the Decree on the Supervision of the Conduct of Financial Undertakings (Bgfo 3).

- All advisers must have a diploma for the subject they are advising on.

- Employees with substantive customer contact who do not advise must also be demonstrably expert. This can be done by means of a diploma or because the insurer has guaranteed this in its own business operations.

- There are nine professional qualifications, each consisting of multiple modules, for which advisors or employees with customer contact can obtain diplomas.

- Until 1 January 2017, advisers who already work in the sector had the opportunity to exchange old diplomas for the new diplomas by means of a catch-up exam.

- Diploma holders have a duty to be 'permanently up-to-date'. In order to maintain the professional qualification, a PE exam must be successfully taken every three years.

An important role is reserved for the Financial Services Expertise Board (CDFD). The college:

- advises and supports the Minister of Finance in the field of professional competence in the context of the Financial Supervision Act (Wft);

- translates the legal professional competence requirements into concrete test terms;

- advises on the equivalence of diplomas with the Wft diplomas;

- is responsible for the recognition of examination institutes and the supervision of the quality of the examinations.

Initiatives of the Covenant

In recent years, the Association has developed various initiatives to support its members in acquiring and maintaining the required knowledge, skills and professional behaviour of employees.

- Permanently up-to-date with the Covenant. Keeping track of professional knowledge is important for all employees of insurers and even mandatory for many. The Association organizes meetings on a variety of topics, so that members can keep their knowledge of current themes up to date. Participants receive a PA certificate, with which they demonstrate that they are aware of relevant current developments. More information about this on the pages of our Insurance Academy.

- PE programmes for key officials. In collaboration with Nyenrode Business Universiteit, the Verbond has developed PE programmes for both key officers and the Boards of Directors/Supervisory Boards of insurers.