The conversation takes place via Teams. Out of necessity, because Belgium is locked down. Prof. Karel Van Hulle "lives and breathes digitally these days". His book Solvency II is good for you was published last year, but COVID-19 ensures that he hardly gets around to promotion. "Before corona, I was involved in at least thirty conferences a year. As a speaker, moderator or chairman. Now everything is digital. I miss the contact with people."

He is corona tired, but adapts to that new reality without complaining. For example, he has been travelling the world virtually for months. "I live on the farm in Belgium, but apart from my lessons at the Catholic University of Leuven, I have no business in Belgium."

On the morning of the interview, he had a conversation with London, among other things. That same afternoon, he will speak with the board of the financial regulator in Bermuda and a day later he will lead a conference in Georgia. "The Georgian market would like to switch to Solvency II (hereinafter referred to as SII). This is true for more countries in Central and Eastern Europe, and in the former Soviet Union. SII is now fully or partially applicable in many places in the world. For example, in South Africa, Israel, Morocco and Algeria. And if we look at Asia: in Japan, China and Hong Kong. In Latin America in Brazil, Mexico and Chile. And finally, here in Europe, Switzerland, among others, has long since embraced the principles of SII. Fortunately, supervision is risk-based everywhere. That is the essence of SII."

Karel Van Hulle was Head of the Insurance and Pensions Department in the Directorate-General for Internal Market and Services from 2004 to the spring of 2013. After thirty years of loyal service to Europe, he called it quits at the age of 61 and it was up to his successor to bring Solvency II to the market. But, as he himself once said in an interview in the Covenant magazine Verzekering! , he did let go of Solvency in his position, but not in his life. In June 2019, his book Solvency II is good for you was published.

Karel Van Hulle was Head of the Insurance and Pensions Department in the Directorate-General for Internal Market and Services from 2004 to the spring of 2013. After thirty years of loyal service to Europe, he called it quits at the age of 61 and it was up to his successor to bring Solvency II to the market. But, as he himself once said in an interview in the Covenant magazine Verzekering! , he did let go of Solvency in his position, but not in his life. In June 2019, his book Solvency II is good for you was published.

Prof. Van Hulle teaches at the Catholic University in Leuven and at the Goethe University in Frankfurt. He is also a member of the Public Interest Oversight Board, an international body that oversees the auditing and ethical standards developed within the framework of the International Federation of Accountants. And finally, he is a member of the Board of the Bermuda Monetary Authority.

"When we put our proposal on the table in 2007, we could never have known that a financial crisis would break out not long after. I even think it was questionable whether SII would have come about if we had submitted our proposal two years later. Insurers argued that they were not the cause of the crisis and therefore no new regulations were needed. What a mistake! After all, it soon became clear that one of the most important consequences was a reduction in interest rates, and that was just the worst thing that could happen to insurers. You also saw that all kinds of mechanisms were put in place to curb the enormous volatility. Each country began to argue, as it were, for its own SII, and that was not our idea of a European framework. So yes, I was happy when the negotiations stopped and there was finally an agreement."

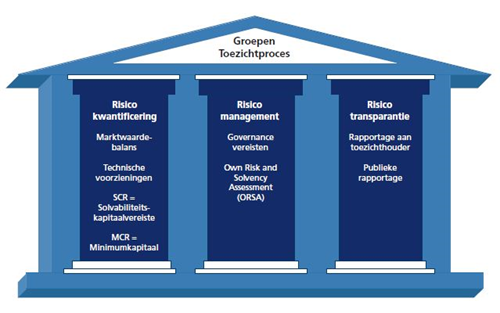

"No, I didn't come up with that. We borrowed the three pillars from the banking sector, which had already introduced a three-pillar regime in 2004, with Basel II. The sector wanted to emphasise that a good solvency scheme is a combination of a quantitative factor (capital), qualitative (good governance and risk management) and transparency, both with reporting to the regulator and the public. We have taken this into account in the development of SII. You can't solve everything with capital. Good risk management and good governance are essential, especially for insurers. To underline the importance of all pillars, I have made a diagram in which SII is presented as a house with three (equally large) pillars and a roof (group supervision). I have often advised insurers and students to hang this scheme above their beds, so that they never forget that solvency is not just a matter of capital."

The Solvency legislation is characterised by three pillars. The first contains the quantitative capital requirements. The second relates to risk management, governance and the ORSA (Own Risk and Solvency Assessment) and the third houses the reporting.

The original completion date of the house, October 2012, has been postponed three times. First to January 2013, then to January 2014 and finally the regulations will be in force from 1 January 2016.

In addition to some minor adjustments here and there, a somewhat larger renovation is now on the way. All parties involved, including the Dutch Association of Insurers, have made their wishes known to the European Commission. Architect Karel Van Hulle expects the renovation to be completed in 2025 (or 2026).

"The world has indeed changed quite a bit, but COVID-19 is not a real problem from an insurance perspective. There is some excess mortality, events are cancelled, etc., but all in all it is manageable. Insurers sometimes had a hard time with the volatility of the financial markets. There were also issues with whether or not the damage suffered from business interruption was insurable, but the main problem of COVID-19 is in the operational risk. Not all insurers were equally well prepared for a digital world, where staff work from home and contacts with customers are only possible virtually. Not all insurers had also covered themselves well for the security of their software against hacking. Regulations must pay more attention to these operational risks. Insurers will have to demonstrate that they can work virtually in a secure environment."

"More than COVID-19. The pandemic will disappear (preferably as soon as possible), but neither will climate change and sustainability. That is why the European Commission has asked regulator EIOPA what changes are needed to the SII structure to contribute to the climate goals of the Green Deal and to the sustainability goals of the United Nations. EIOPA has already made a number of proposals – including a more long-term approach to assessing risk and setting up internal models – but if you ask me, insurers can already change their policies. For example, by no longer investing in shares of polluting companies. Or by no longer providing cover to these companies. There is no reason to wait for regulation. In fact, by emphasising good risk management, SII actually encourages action."

"SII is not a no-failure regime. Technically, it is still possible for an insurer not to survive a major storm, but the capital position of most European insurers is very comfortable. COVID-19 has not changed that. On the contrary, both insurers and regulators want to keep the capital position as strong as possible. Sometimes even too strong. It is not necessary for the solvency ratio to be 150, 200 or sometimes even 1,000 percent. Through regular adjustments, the structure is and remains well secured. Even extreme stress tests show that a lot has to be done before the insurance sector gets into trouble."

"I agree that there is no reason to increase the capital requirements now, but that is not EIOPA's intention either. Their proposal states that they do not want to increase the general capital tax of insurers. I know that there are many insurers, not only in the Netherlands, who think the new requirements are too high, but I really think it is too early to judge that now. The discussion has only just begun and, moreover, what is now on the table is 'only' a proposal from the European regulator. I want to see the complete picture before I make my judgement."

"The fact that insurers now hold more capital than necessary does not make me think so. The fact that they can do so proves that there are no dramatic standards. But if you're talking about the risk margin, which is actually an extra capital buffer that insurers have to maintain when calculating the technical provisions, then you're right. The risk margin is now based on six percent and that could be reduced somewhat."

"Between two and three percent would be realistic, but the method of calculation must also be adjusted. It's quite technical to explain that in detail, but it means that we have to look even more at the real risk."

"I really think that's the most difficult part of the whole structure. Because what is the real risk of long-term products? That presupposes that we speak out about the future and that future is by definition unpredictable. That is precisely why we have to model that risk, but every model is relative. I hope that the revision of SII will find a better way to reflect this risk. Currently, insurers mainly look at the market value, which leads to volatility in times of low interest rates, while they should perhaps pay more attention to the economic, intrinsic value. That is also the message of SII. The structure is based on an economic balance sheet, which is not necessarily a balance sheet that only looks at the fluctuations of the market."

"I understand that wish. When the crisis in 2009 led to low interest rates, the structure became too volatile. That is why the Volatility Adjustment was introduced. I have no problem with it if that becomes company-specific, but then under the heading of equal monks equal hoods. If every Member State can work it out as it wishes, I think it is a problem. Then the European system becomes a national system and I don't like national sauces."

"I would like the review to be used to strengthen the structure, so that insurers can better 'master' the challenges. By this I mean, in addition to climate change and sustainability, also a risk such as cybersecurity. As far as I'm concerned, the review should be better focused. There is so much on the table now that you can no longer see the forest for the trees. That is wrong. It is not a purely technical exercise, but a fundamental reflection on the building itself. And that structure should help insurers to fulfil their role as professional risk managers as well as possible. This means that capital requirements must remain reasonable, in proportion to the risk assumed, and that no new rules are introduced if they are not strictly necessary. Another great wish of mine is a better treatment of long-term liabilities and the associated long-term investments. Incentives should be built in to gently force insurers to take more and better account of the consequences of climate change, and of the need to build a more sustainable society."

"What a wonderful final question. SII is risk-based and I wouldn't know what else to do than that. SII is superior as a structure and that makes it a sturdy structure. My answer to your question is therefore short but sweet: Over my dead body!"

(Text: Miranda de Groene, Photography: Ivar Pel)

Karel Van Hulle already had the title of his book, even before he started writing: Solvency II is good for you. "I have often used that title in presentations. In total, I have always concluded hundreds of lectures on Solvency with that slogan."

Karel Van Hulle already had the title of his book, even before he started writing: Solvency II is good for you. "I have often used that title in presentations. In total, I have always concluded hundreds of lectures on Solvency with that slogan."

The reason for the title is many. In this way, Van Hulle wanted to describe not only the creation, but also the significance of Solvency II in his book. "I know from experience how quickly people forget why certain rules were ever introduced. I wanted to tell the basic principles again and in such a way that everyone knows why it is the way it is. I wanted a book that describes clearly – even for a layman – what SII is, why it was introduced and what meaning it has for everyone who has to deal with it. And you guessed it: that's all of us. So SII is also good for you."

In addition, Van Hulle wants to use the title to make clear the great social importance of insurance. "I myself entered the insurance sector late. Actually, as it goes with (almost) everyone, that was never my intention. But once I started to delve into the sector, I was immediately struck by its social relevance."

He has therefore deliberately chosen to kick off his book with the chapter What is insurance? "Many publications about SII are based on a high level of knowledge and are packed with all kinds of formulas. I wanted to explain first what insurance actually is, because few people understand the logic between risk and premium. And if you want to understand SII, you also have to think about the insurance product. Insurers take the real risks into account in their system. In other words, they ensure that life becomes liveable and that is good for the consumer. The problem is that hardly anyone realises this and insurers themselves are not good messengers. They get into technical details too quickly."

"Besides," Van Hulle concludes, "sometimes it's better if someone else says it. SII is good for you and for me, because it allows insurers to be creative and not to make promises that they cannot keep (afterwards)."

Unlike many other books on Solvency, Van Hulle's book does not contain a single formula. More information: Solvency Requirements for EU Insurers: Solvency II is good for you, Intersentia, ISBN 978-1-78068-177-1. "A nice Christmas present," Van Hulle concludes with a wink.